By James P. Economos, DDS, Opinion Contributor

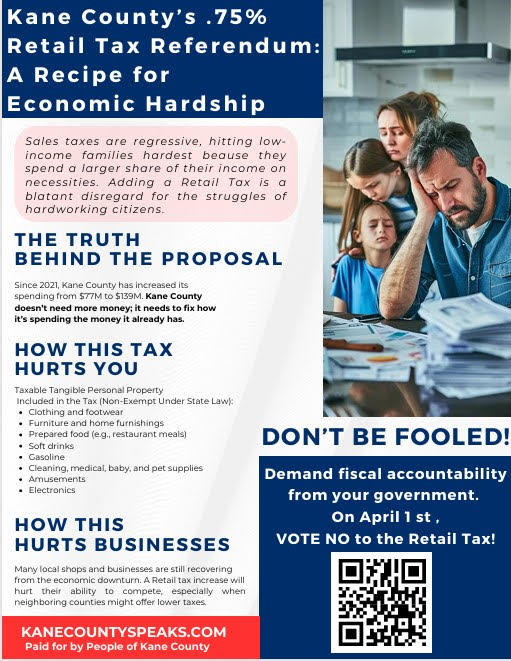

In Kane County, Illinois there’s a referendum to create a. 0.75 percent retail sales tax on April 1, 2025. (April Fool’s Day)? This would be the first county sales tax imposed since the County was incorporated in 1836. This may seem like a very small amount, as it’s less than 1 percent, yet in total gives $51 million to politicians.

Once a new tax starts, they may grow. This is yet another example of the need to vote in every election, not just in the major one we just had last November. Kane County residents need to vote NO as more taxes are not the answer.

Proper governance is.

When the Federal Income Tax was first bracketed in 1913, the rate was 1 percent. This rate has gone up and down like a yo-yo since. Today the top rate is 37 percent. History is replete of many taxes starting off as just a “small amount or just temporary,” as was the case with Illinois State Income Tax. How’s that worked out since? Kane County does not need this tax.

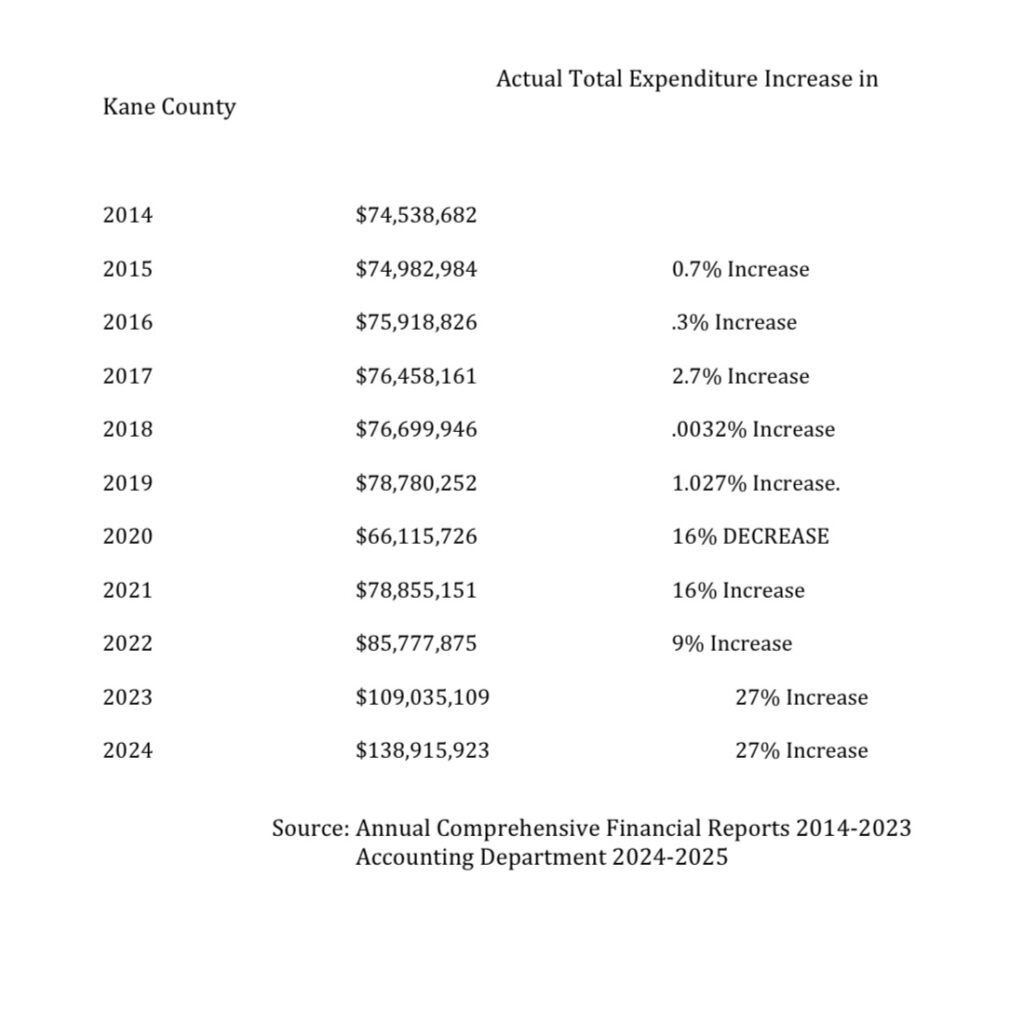

Why is this even being proposed? It’s because of poor management by Kane County Chairman Corinne Pierog and the Democrat majority on the Board. There was a budget surplus of $400 million in various accounts when former chairman Chris Lauzen left in 2020. The annual budget expenses was about $88 million annually. It’s ballooned to $139 million since. Seeing the mismanagement in just two years, caused Lauzen to run as the County Treasurer so he returns some common sense to the out-of-control county government.

To put things into perspective, there are two topics to understand in terms of overall money and the annual budgets. Since the California fires have been recent news, let me compare California’s mismanagement to what is happening in Kane County.

There was about $400 million in their financial reservoir in 2020. Due to excess spending, the reservoir is down to about $300 million now. The financial reservoir’s down 25 percent in just four years. California allowed their reservoirs to run dry and how did that work out? Kane County needs does not need dry reservoirs. Deficit spending will cause this to happen.

The annual budget is analogous to a water spring which feeds reservoirs which keeps the financial levels where they should be. If the reservoir starts to dry up due to less water flowing into it, it will dry up just as did California’s did. A dry financial reservoir would not be good for Kane County.

People in Kane County need to go to the polls to vote NO to this proposed sales tax.